The Israel-Hamas war has had a profound impact on global oil prices, affecting both supply and demand factors in the international oil market. The net effect depends on the specific dynamics of the conflict, market sentiment, and the overall geopolitical landscape. As a result, careful analysis and monitoring of oil prices in the context of the Israel-Hamas war is crucial for understanding its complex impact on the global oil market.

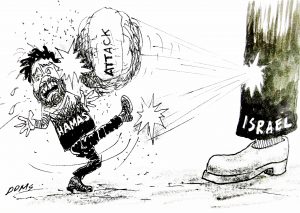

First, it has raised concerns regarding oil supply disruptions in the Middle East. The region is a vital oil-producing area, with major countries like Saudi Arabia, Iraq, Iran, and Kuwait being key players in global oil production. Any escalation of conflict in the region, particularly in Israel, can potentially disrupt oil production and transportation routes. Investors and traders react to such uncertainties by bidding up oil prices, as the perceived risk of supply shortages increases. The fear of supply disruptions due to the Israel-Hamas war puts upward pressure on oil prices in the global market.

This war also affects oil prices by influencing geopolitical tensions. The conflict amplifies regional instability and increases the risk of broader confrontations between other countries in the Middle East. Oil markets are highly sensitive to geopolitical events, as they can directly impact oil-producing countries or trigger speculative moves in the markets. Heightened geopolitical tensions raise concerns about potential supply chain disruptions or even military conflicts in oil-rich countries, leading to a speculative rise in oil prices. As oil prices are determined by market sentiment, the mere perception of increased risks can cause price volatility.

As conflicts escalate, economic activities may be impacted, leading to a decrease in oil demand. The destruction of infrastructure, disruptions in transportation systems, and the imposition of sanctions or embargoes can hinder economic growth, reducing the need for oil. Decreased oil demand can result in a downward pressure on prices. However, this effect may be somewhat mitigated by the geopolitical tensions caused by the war, which can push some countries to increase their strategic oil reserves, thus temporarily boosting demand and supporting oil prices.

It’s up to the oil regulatory bodies in every country if they cushion this impact or not because failure to do so will certainly result in a crisis, to the disadvantage of the business sector for the most part. In our country, this impact will surely be felt, in all sectors of society. Remember, oil price hikes likewise result in price increases of almost all commodities.