Recently, I just saw someone boasting that she earned P20,000 in five days from merely “copy-pasting” Facebook ads. All she needed, she claimed, was “grit” and “a phone.” I could see my brain thinking: this is not hustle—it’s highway robbery in disguise with hashtags.

Because let’s be real, most of these online “opportunities” are nothing but clever scams dressing up as the digital carnival. They strut around as hasty exits from poverty, but they are better described as highly oiled money vacuums extracting cash right from desperate individuals’ pockets. The setup is always the same: a promise of instant money, a series of screenshots with GCash notifications, some motivational quotes, and a person telling you, “If I did it, so can you.”

But the one thing that they never mention is that before you can even hope to make any money at all, you’ll first be required to pay—perhaps a registration fee, perhaps a “starter kit,” or worse, a “membership” that guarantees to unlock the gates of gold towards a life of luxury. Ironically, that P999 you spent? That’s their real earnings. Not the enterprise. Not the item. You. You are the commodity.

I’ve witnessed starry-eyed job applicants, fresh graduates, and solo working moms lured into this virtual existence of phony enterprise. Something repulsive about the way such scams use people’s aspirations against them. They use the parlance of the dreams—”Be your boss,” “Financial freedom,” “Break the 9-to-5”, but there is a very real manipulative psychology of want and insecurity hiding behind the veneer of smoothness. The irony? They tend to bloom best in economically troubled communities where a P500 increase in earnings is heaven-sent. They do not construct communities—instead, cults of illusions are constructed.

And don’t even talk to me about so-called “mentors” and “coaches.” These so-called gurus post up reels of them sipping frappuccinos, jetting off on planes, and soaking up the sun in condos that they likely don’t even own. Their greatest talent is marketing the idea that they have solved the equation for wealth, when in fact, they have solved the equation for making money off of people’s trust. Their bios say “entrepreneur,” but the only enterprise they’re running is a pyramid scheme disguised as empowerment. It’s predatory, but worse—it’s normalized.

They’re smart, I’ll give them that. They know how to use language like a fishing net, throwing around terms like “passive income,” “affiliate marketing,” or “drop shipping” to sound legitimate. But the structure is always suspect. If your business model collapses when new people stop joining, that’s not a business—that’s a ticking time bomb. And if your earnings depend not on selling a product or service, but on convincing someone else to join, then you’re not an entrepreneur. You’re just a cog in a money-making contraption that only fattens the pockets of the few at the top.

Social media is part of this game of deception to an unprecedented extent. Social media offers the platform, the audience, and the layer of legitimacy. It’s where lies are given a veneer of sheen with filters and affidavits. The online world pays for popularity, not honesty. The more improbable it is, the more it will be noticed—and in our times, attention equals money. Once you possess the influence, you can peddle anything. Even lies. And everyone will be eating it because it’s sporting the uniform of success.

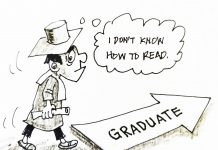

Sadly, such scams never get reported, seldom get punished, and seldom get questioned by participants. The victims blame failure on themselves since they “had not worked hard enough” or “did not have faith in the system,” as if failure was a personal failure, rather than a failure of structure within the scam. It is a culture of deceit, shame, and silence. And so long as these dubious systems have their way and use people’s needs and dress them up as opportunities, we will keep raising a generation that pursues illusions and does not believe in honest hard work.

Perhaps the antidote is optimal if it’s not only warning individuals. It’s turning them into critical thinkers—making financial literacy something people talk about every day, particularly with younger generations. It’s revealing these cons for what they really are, calling names, and not glamorizing anything that guarantees money for no work. Because in this world, anything too good to be true is most likely not just not true—it’s a trick, and someone’s already counting on making money off your mistake.